Lynn Parramore interviews Lance Taylor over at INET:

Lynn Parramore interviews Lance Taylor over at INET:

Lynn Parramore: In your new book, you name wage repression as the biggest driver of inequality in the U.S. over the last several decades. Your conclusion differs from many who have studied the issue, such as Thomas Piketty, who theorized that inequality is caused mainly by a tendency of profits to run ahead of the growth rate in the economy. What’s different about your take?

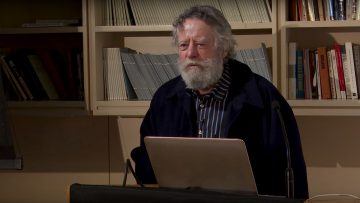

Lance Taylor: Piketty & Co. deserve a lot of credit for using tax and other data to estimate how income distribution differs across households over 200 years. The question is, what explains these differences?

I wanted to analyze how income differences among various kinds of households (poor, middle class, and affluent) came about over time. That meant drilling down into macroeconomic indicators as well as the data associated with the various industries in which people worked and the streams of income they received from them.

Özlem Ömer and I assembled what we needed by reworking Congressional Budget Office data along the lines of the U.S. Bureau of Economic Analysis (BEA) National Income Accounts. This allowed us to look at both macroeconomics and individual industries or sectors — 16 in all.

We studied changes in the structure of payments, employment, and output of products and services across these 16 sectors. What we found is that except in volatile and low-profit agriculture and mining sectors, real wages grew less rapidly than productivity since around the time of Reagan’s presidency. Wage shares decreased, but profit shares increased at the industry and macro levels, and the money from those profits ended up in the pockets of business owners and the wealthy instead of being shared.

For the most part, Americans workers have been working more productively, but they haven’t been getting paid for it due to forces that aren’t natural and inevitable. Wage repression doesn’t just happen.

More here.