by Pranab Bardhan

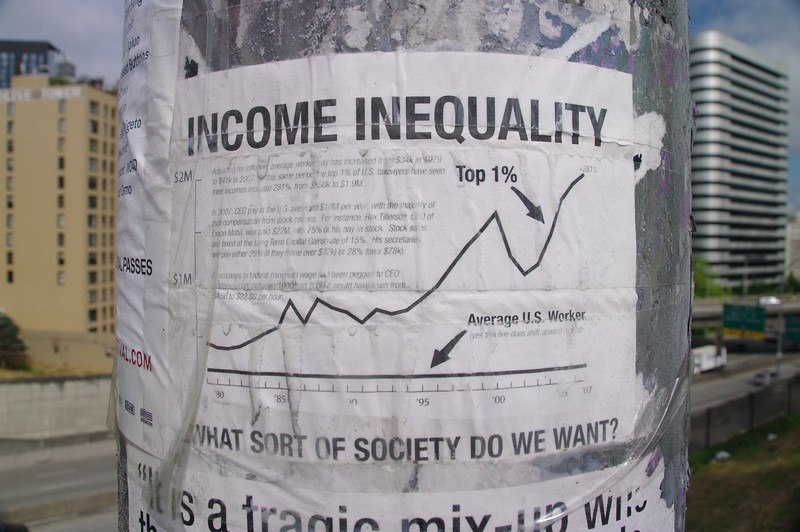

There is widespread concern about increasing or high economic inequality in many countries, both rich and poor. At a global level, according to the World Inequality Report 2018, the richest 1% in the world reaped 27% of the growth in world income between 1980 and 2016, while bottom 50% of the population got only 12%. Over roughly the same period, however, absolute poverty by standard measures has generally been on the decline in most countries. By the widely-used World Bank estimates, in 2015 only about 10 per cent of the world population lived below its common, admittedly rather austere, poverty line of $1.90 per capita per day (at 2011 purchasing power parity), compared to 36 per cent in 1990. This decline is by and large valid even if one uses broader measures of poverty that take into account some non-income indicators (like deprivations in health and education) for the countries for which such data are available.

There is widespread concern about increasing or high economic inequality in many countries, both rich and poor. At a global level, according to the World Inequality Report 2018, the richest 1% in the world reaped 27% of the growth in world income between 1980 and 2016, while bottom 50% of the population got only 12%. Over roughly the same period, however, absolute poverty by standard measures has generally been on the decline in most countries. By the widely-used World Bank estimates, in 2015 only about 10 per cent of the world population lived below its common, admittedly rather austere, poverty line of $1.90 per capita per day (at 2011 purchasing power parity), compared to 36 per cent in 1990. This decline is by and large valid even if one uses broader measures of poverty that take into account some non-income indicators (like deprivations in health and education) for the countries for which such data are available.

If absolute poverty is declining, while measures of relative inequality (of income or wealth) show a significant rise (or remain very high), this implies that the conditions of the poor may be improving, but those for the rich may be improving much more. But if people are less poor than before, should we be concerned about high or rising inequality, about how much better-off the rich are, and, if so, why? This is an important question on which more clarity is needed, as quite often when people tell you why they dislike inequality many of the examples they cite are really about their aversion to the stark poverty around them.

To moral and political philosophers steeped in the theory of justice inequality in society may simply be ethically distasteful. To utilitarians increasing income inequality, controlling for the average income, reduces social welfare simply because the same dollar has lower marginal utility for the rich than for the poor. Many non-utilitarian philosophers also find some kinds of inequality simply unconscionable. There is, however, an important discussion among philosophers (and some economists) about the kinds of inequality which are morally permissible. The latter, for example, may pertain to cases where between two individuals facing similar life chances one may end up richer than the other simply because the former is more ambitious or hard-working than the latter. This brings to the fore a distinction between inequality of opportunity and that of outcome. As philosophers, public commentators and the general public increasingly find the issue of personal responsibility in one’s choice or life decision quite socially salient, one can make a clear distinction between opportunity-egalitarianism—seeking to offset only those inequalities that are due to circumstances beyond an individual’s control (like the characteristics of a family or neighborhood a child is born in or its biological characteristics)– and outcome-egalitarianism that, often on grounds of social norms, seeks to offset even those differences in outcome that are due to an individual’s own choice (say, in blowing away one’s opportunity by indulging in drugs or alcohol) or initiative (or lack of it).

Many economists take a much narrower approach on inequality, even when they are sensitive to issues of absolute poverty. They find relative inequality acceptable if it does not harm economic performance or efficiency; in fact they are prepared to tolerate even a large dose of inequality if it improves the aggregate economic performance—the presumption is that the larger surplus keeps open the possibility of redistributing some to the poor (a possibility that is infrequently realized in actual politics), thus making everyone better-off. The main purpose of this essay is to indicate why we may have sufficient reasons to worry about inequality even from this narrow economist’s point of view.

Most undergraduate economics textbooks to this day talk about an equality-efficiency trade-off. This is mainly about the disincentive effects of attempts to redistribute income from the rich to the poor. Progressive taxes to fund such redistribution may discourage work effort, investment and risk-taking, and the consequent shrinking of the pie may leave the poor worse-off compared to the case of a larger pie but with the same share as before. Economists have compared such redistributive transfers with carrying water in ‘leaky buckets’.

In general, it is argued, allowing inequality is a way of encouraging entrepreneurs and other fortune-seekers, whose enterprise, new ideas and innovations enrich them but also improve the conditions of the whole economy from which others can benefit. The wealthy are more willing and able to take risks with new ideas, and hence redistribution may reduce productive risk-taking if it transfers wealth from less to more risk-averse agents (unless there is a public risk insurance policy to cover it so that even people with limited means are induced to take more risks). It is also the case that the rich save more than the poor, so inequality can generate more savings and investible funds which can expand the productive base of society. Such expansion or growth may eventually trickle down to the poor (though economists on the opposite side usually argue that such trickle-down is not enough). Both sides, however, can agree that high inequality may weaken the poverty-reducing powers of the same growth rate.

But the last few decades of advance in economic theory and empirical findings have raised questions about the general applicability of the very idea of equality-efficiency trade-off. In the rest of this essay we shall enumerate and examine some of the relevant issues here.

- When there is information asymmetry between the two sides in a given economic transaction the above-mentioned trade-off may not hold. For example, creditors do not have enough information about the viability of a project brought to them by a potential borrower. You may have a project that you know is very much worthwhile from both private and social point of view, but the creditor may not be aware or convinced of it, and you do not have sufficient collateral to persuade the creditor to take the risk of lending to you. A rich man with an inferior project may get that loan, not you, because of the former’s larger assets, and hence collateral value. Thus inequality here promotes the less efficient outcome. Similarly, your low savings or collateral may not permit you to finance or borrow for investment in higher education for which you may otherwise have the talent and proficiency, whereas the less talented children of your rich neighbor go through college and university, while you drop out. This is a loss to society as well as yourself.

- There is, of course, a great deal of socially unproductive risk-taking by the rich (with ‘collateral damage’ for the poor), say, in financial or real-estate speculation. Even if we ignore this, it is important to keep in mind that not all dynamic innovations and productive risk-taking are by private fortune-seekers. In the US much of the basic or foundational research and great innovations of recent times (like the Internet, GPS, Digital Search Engine, Supercomputers, Human Genome Project, Magnetic Resonance Imaging, Smart Phone Technology, Hydraulic Fracturing for Shale Gas, and a whole host of others) have been facilitated by or been the outcome of public investment funded to a large extent by taxpayer money. Scandinavian countries with a high-tax redistributive economy have not been lagging in innovations.

Even in the private sector assuring temporary monopoly and thus great fortune for the innovator through the patent system has not been the only or the best way of encouraging innovations. Patents on a new technology often make things costly or obstructive for future innovators and thus may hamper further advances in technology. Open-source programs are often more conducive to new developments of technology.

- If inequality is generated by market power of big firms in product and labor markets, then there is a direct loss of efficiency (in output and employment) if that market power enables those firms in their attempt to maximize profits to restrict output (and labor hiring) below the amounts for a competitive firm.

- Historically, the case where inequality and inefficiency have stubbornly persisted together relates to land, which is usually very unequally distributed. In traditional (and in some non-traditional) agriculture the empirical evidence suggests that economies of scale in farm production are not inherently substantial (except in some plantation crops) and that the small farm is often the most efficient unit of production (if credit, insurance and marketing facilities are not inadequate). Yet the violent and tortuous history of land reform in many countries suggests that numerous road blocks on the way to a more efficient reallocation of land rights are put up by the powerful landed interests for many generations. Why don’t the large landlords instead voluntarily lease out or sell their land to small farmers and grab in the bargaining process much of the surplus arising from this efficient reallocation?

There clearly has been some leasing out of land, but problems of monitoring the tenant’s work and application of inputs, insecurity of tenure (discouraging long-term land improvements by the tenant), and the landlord’s fear that the tenant will acquire occupancy rights on the land have limited efficiency gains and the extent of tenancy. The land sales market is often rather thin (and in many developing countries the sales sometimes go the opposite way—from distressed small farmers to landlords and money-lenders). With low household savings and collaterals, the potentially more efficient small farmer is often incapable of affording the going market price of land.

Landlords on the other hand often resist land reforms particularly because the leveling effects reduce their social and political power and their ability to control and dominate even non-land transactions in the village. Large land holdings may give their owner special social status or political power in a lumpy way—for example, the status or political effect from owning 1000 acres is larger than the combined status or political effect accruing to 50 new buyers owning 20 acres each. Thus the social or political rent of land ownership for the large landowner may not be compensated by the offer price of numerous small buyers. Under the circumstances the former will not sell and inefficient (from the productivity point of view) land concentration persists.

- Then there is the demand-side impact of inequality. There is a story of a Ford company executive in conversation with a union leader, pointing to the arrival of a bunch of robots in the factory and asking, “can you collect union dues from them?”, to which the union leader replied, “can you get them to buy Ford cars?”. Particularly, in times of depressed aggregate demand and idle capacity, inequality may hurt macroeconomic performance by making it difficult to stimulate enough mass consumer spending. Recent research suggests that a long-term rise in inequality can push the economy into a deep recession. There is also some evidence that inequality has encouraged excessive risk-taking in the financial sector, and along with household indebtedness may have been responsible for the financial crisis that originated in the US in 2007-8.

- Under inequality not merely the aggregate consumer demand may be deficient, but the pattern of consumer spending may also get distorted. Certain types of consumer spending on status goods (houses, cars, and other easily visible conspicuous consumption items) can, in the context of inequality and community norms of emulation and the resultant ‘expenditure cascade’, lead to a race to the bottom among neighbors and reference groups: clearly an inefficient outcome.

- The link between inequality and crime has often been pointed out both in scholarly and popular discussion. There is empirical confirmation of the association between inequality of visible or conspicuous expenditure and violent crime, as there is also evidence from several countries of a positive relation between income inequality and property crimes and violent crimes like robbery, homicide and murder. A visit to cities like Nairobi, Johannesburg and Rio de Janeiro, to take the cities in three highly unequal countries, often makes it plain even for the most casual observer.

- Similarly, the link between inequality and social and political conflicts (and hence economic disorder and instability) is also often suggested. Here the evidence is more mixed. There are several reasons for this. First, one is not always clear about the nature of conflict one wants to study—conflicts can range from industrial strikes and agitations all the way to violent civil wars. Secondly, for most of these conflicts grievance arising out of economic disparity is not enough; one needs resources, organization, agency, initiative and leadership to mobilize action that takes the form of conflict, and, more importantly, to sustain it, as the long history of failed rebellions and suppressed popular resentment would testify. Thirdly, when group conflict arises out of inter-group disparity, the measure of disparity that may be more relevant than that of usual inequality is what some scholars measure as polarization, which takes into account the depth of cleavage or distance between the groups, as well as their size. Fourth, conflict may originate in the tension that may grow more from the change in the relative income status of two even similar groups rather than the over-all level of inequality. Then there is what is called the Tocqueville paradox– in his words: “The hatred that men bear to privilege increases in proportion as privileges become fewer and less considerable, so that democratic passions would seem to burn most fiercely just when they have least fuel”.

- Just as the evidence on the relation between inequality and conflict is mixed, that between inequality and the obverse of conflict, i.e. cooperation (whether in team production efforts, or in resolving disputes in collective action, or in the management of the local commons like forestry, fishery or irrigation water) is also not straight-forward. I have a co-edited book, Inequality, Cooperation, and Environmental Sustainability (Princeton University Press, 2007) on this subject.

A review of the empirical literature on, for example, the relation between inequality and cooperation in management of water resources for irrigation in developing countries shows the complexity of the relation. There are sometimes important initial set-up costs in an irrigation management regime, which the rich and powerful people in the village often provide or take the leadership in mobilizing and sustaining. On the other hand, there is quite a bit of evidence that relative equality helps in the formation and maintenance of water user associations, in the following of water allocation rules and in the broad-based resolution of water disputes. There is also similar evidence in the community management of forests, fisheries and grazing lands.

The empirical evidence is, however, often deficient in providing sufficiently refined data to discern among varied theoretical hypotheses about norms, bargaining power and perceptions of fairness under situations of inequality. Experimental evidence suggests that people whose fallback positions are very different are less likely to come to agreements than are more equally-situated ones. Also, under inequality bargaining failures may occur because inequality heightens informational asymmetries among the bargaining partners, or because very unequal offers based on disparities in initial wealth or bargaining power are likely to be perceived as unfair and rejected (as one usually finds in experimental play of what are called ‘ultimatum games’).

- It is quite common to observe in the labor market (which is qualitatively different from markets in say, vegetables, as it more directly involves social institutions and norms) that perceived inequality may disrupt norms of individual dignity and autonomy of the worker, and thus affect labor discipline, loyalty, turnover, and ultimately productivity. Looking particularly to the future patterns of work, as the nature of human work is likely to involve more personalized or customized (including care-giving) services and more of production and dissemination of knowledge, the role of intrinsic motivation (i.e. when you do something largely for your own satisfaction/esteem not just for external rewards) and of shared norms inherent in these lines of work will be increasingly important—perceived inequality palpably affects these motivations and norms.

- It has been widely observed and commented upon that economic inequality enables the rich and the corporate sector to pour resources in the political influence machine to get the system to work in their favor, particularly through lobbying (not just in improving access, but in the US the lobbyists now actually develop and draft the legislation in some cases, and even are put in charge of its implementation) and election finance. This often results in laws and regulations in favor of wealth concentration and perpetuation of plutocratic power and away from efficient outcomes, apart from undermining democracy. Corporate power in lobbying, bribing, election-funding and media-shaping is rampant in many developing countries as well.

- Another political mechanism through which inequality can affect efficiency in the delivery of public services is what is called ‘secession of the rich’: rising inequality is usually associated with the rich opting out of public services and turning to private providers (private schools, nursing homes, gated communities for safety, etc.); this ‘exit’ results in a lowering of the general quality of public services as they lose influential political support (‘voice’).

- Social inequalities also have adverse economic efficiency effects. In countries of acute gender inequality women’s education, health and work participation suffer, and this has negative consequences not merely for the women themselves, but also for the children that these women bring up. Thus society pays the price of gender inequality across generations.

Similarly, if there are serious inequalities across neighborhoods and localities, a child born in a backward area will have inferior schools, roads and other facilities, and less exposure to good networks, peer groups, and role models in the neighborhood and other forms of social capital. This has obvious effects on future economic performance of the child.

We have thus considered several reasons why inequality can have serious inefficiency consequences even from the narrow point of view of economists, belying their traditional dogma of equality-efficiency trade-off. Inequality is thus not just ethically distasteful, it can be economically harmful, even ignoring problems of absolute poverty.