by Carol A Westbrook

“Medicare for All” is a battle cry for the upcoming national elections, as voters’ health care costs continue to skyrocket. Universal Medicare, they believe, will provide free health care, improve access to the best doctors, and lower the cost of prescription drugs. Is it a dream, or is it a nightmare?

I am 100% in favor of universal health care, but believe me, it ain’t gonna be free. True, I’m not an economist–I’m a doctor–but I can do the math. I’ve had years of experience, both practicing under Medicare’s system and as a Medicare patient, and I understand something about health care costs. Few voters under age 65 understand what Medicare provides, and even fewer have a grasp on what it will cost the government–and ultimately the taxpayer–to extend it to all.

What Medicare provides for free is Medicare A insurance, which covers inpatient hospital, costs. To cover outpatient and emergency room visits, the senior must purchase Part B, which covers 80% of these charges. Medicare B costs $135/month plus a sliding scale based on income. Prescription drug coverage requires purchasing Medicare D from a private company. (Medicare C is alternative private insurance). Medicare A, B and D premiums are all deducted from the monthly Social Security check. Additionally, a senior may purchase a Medicare Supplement from a private insurance company, which covers the un-reimbursed Part A, and B costs. Confusing? Here are two examples.

The first example is a senior whose only income is Social Security and a small pension. Medicare A & B insurance could be had for $135/month ($1,620/year), providing bare bones coverage for hospital and outpatient. He’d have to pay his 20% co-pays, and rely on generic prescription drugs. His medical costs would be low unless he contracted a serious chronic disease, required expensive medications, or had a long hospitalization–these charges would be catastrophic. It’s a risky business to go only with minimal coverage, but about of half of Medicare recipients live like this.

The second example is a retired professional, age 69, living comfortably on retirement savings and consulting income. The monthly, income-adjusted costs for Medicare A, B, and prescription drug coverage D, come to $475, or $5700 per year, which is $11, 400 for a family of two. To this add private supplemental insurance and dental, bringing this to $8136/year or $16,272 for the couple. This is comparable to what an average non-senior family of four pays yearly for health insurance.

The retiree in example two has excellent coverage, with few co-pays and good prescription drug options. She’s driving the “Cadillac” of Medicare; the poor fellow in the first example is driving an old Chevy, hoping it doesn’t break down! If it does break down, he has the option to increase his coverage, but he has to wait until open enrollment in November.

The value of Medicare goes beyond the fiscal, though. It gives all seniors the reassurance that they have health care. They can go to (almost) any doctor or hospital, or walk into any emergency room, knowing that they can get care if, and when, they need it. It means anyone over 65 will be able to get affordable health insurance after they retire, regardless of pre-existing conditions. It reassures children that their ailing parents will have access to medical care. It is truly security — social security.

Sounds too good to be true! Why don’t we give Medicare to all, by starting Medicare at birth instead of age 65? That would be a great idea, except for a minor detail: money.

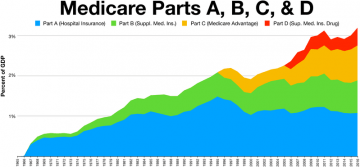

Last year, Medicare spent about $585 million to provide healthcare to its 44 million enrollees, about $13,250 per person. That’s quite a bargain, especially considering that seniors have the highest health care expenses of any age group. But as the graph below shows, only a small fraction came from the recipient’s premiums; most comes from US general funds (tax revenue) and Medicare payroll taxes, all of which are paid primarily by younger wage earners. If you were to divide this pool of dollars among the 350 million people that comprise the US population, it would only provide $1,650 per person– barely enough to pay for a year’s supply of band aids and Tylenol!

That is because health care spending in the US is about $10,000 per person, which is double what most first-world countries spend.

That’s correct; the US spends about $3.4 trillion per year on health care, which is close to the $3.7 trillion that the Federal Government collects on income taxes –the entire Federal budget! If we provided free insurance–Medicare for all– these funds would come from taxes. How much tax? If you were to distribute the health care budget among 138.5 million taxpayers in the US, it comes to a whopping $24,550 per person in extra taxes each year!

I have no idea where to get these extra funds–as I said earlier, I’m a doctor, not an economist–but it’s clear that Medicare for all will be an expensive proposition for tax-paying Americans, however much it might lower out-of-pocket health costs.

But supposing we could lower the cost of health care to be comparable to what an average European country spends–$5,000 per person. If so it might just be possible to use federal dollars to support Medicare for all.

So that’s it — problem solved. Increase taxes modestly and cut the cost of health care by half. Where do we make these cuts?

First, let’s understand why we pay so much for health care compared to European countries. Basic costs include the salaries of the doctors, nurses and receptionists, as well as the operating costs of the facility–mortgage, carpets, maintenance, heating and air conditioning, parking lots, and so on. These costs should be about the same for all.

But the American system has added so much more: Salaries are needed for non-medical staff, like billing specialists, accountants, administrators, greeters, patient hosts, and others that would make your clinic visit easier to bill, and possibly pleasanter. Operating expenses also include executives’ salaries, malpractice insurance, and advertising. Collections above this amount this might go into “profits,” which a non-profit organization like a hospital would have to apply to charity care and capital expenses, like expansion and newer equipment, nice chairs and chandeliers in the lobby. And of course, our health care dollars pay for profits reaped by pharmaceutical companies and insurance companies. Decades of unrestricted health care payments have allowed these non-essential services to expand and take up more health care dollars than go into actual patient care.

Cutting costs should be straightforward because Medicare sets the price of what it will pay based on a published set of standard fees for the service. If the facility accepts any Medicare patients it has to accept Medicare’s payments, and cannot charge anything extra. Because it is not practical for a clinic to exclude all patients over 65, Medicare is accepted, and the clinic finds another way to cover their inflated costs. This is done by increasing the costs to non-Medicare customers.

Here is a true example of how this dual-price system works. After my recent clinic visit, a bill for $1,408.00 was sent to Medicare. Medicare’s amount for this service was $249; they paid 80% of the $249, while the remaining 20% ($49.31) was my 20%, paid by my supplemental insurance. The clinic collected $249 and I paid nothing. If I were a younger person with health insurance I’d pay a lower, negotiated amount, perhaps $600. If I had no medical insurance I’d be liable for the entire $1408! It is hard to imagine that a single clinic visit costs as much as round-trip airfare to London, where I could get the same care for a fraction of the cost.

What did it really cost to pay for my clinic visit? It’s impossible to determine, though many economists have tried. But under our current health care system, the cost is considerably more than Medicare paid. And if every doctor, clinic, hospital, emergency room and health care facility suddenly had to rely only on what Medicare reimbursed, the results could be disastrous.

Picture what it would be like if. First of all, many clinics would go bankrupt and have to close. Whole communities would find they had no local clinics, and emergency care would be miles away. Waiting times for admissions would be high. Hospitals would be dangerously overcrowded and understaffed, leading to more errors and complications. The remaining facilities would be shabby, poorly maintained, with outdated equipment and inadequate staffing. Patient satisfaction scores would go down–but then, few facilities could afford to fund these surveys so there would be no patient feedback.

Picture what it would be like if. First of all, many clinics would go bankrupt and have to close. Whole communities would find they had no local clinics, and emergency care would be miles away. Waiting times for admissions would be high. Hospitals would be dangerously overcrowded and understaffed, leading to more errors and complications. The remaining facilities would be shabby, poorly maintained, with outdated equipment and inadequate staffing. Patient satisfaction scores would go down–but then, few facilities could afford to fund these surveys so there would be no patient feedback.

Millions of jobs would be lost, because one in eight Americans is employed in the health care sector. And residency positions for physicians-in-training would disappear, because Medicare earmarks funds for these jobs. Without these subsidies there would be no future generations of physicians, and we would have to rely on foreign-trained, poorly-licensed doctors–if they even wanted to practice in these shabby facilities.